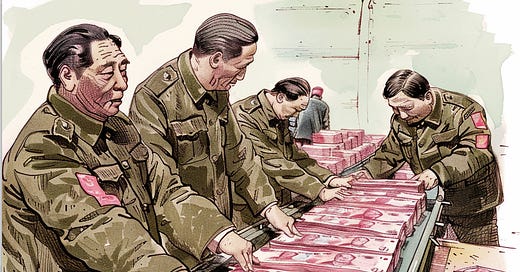

China "wrings the water" out of the money supply in May

Regulatory efforts to combat arbitrage have compounded the impacts of weak confidence on money supply growth

China saw faltering growth in its money supply in May, as the economy continued to grapple with want of confidence amongst households and businesses.

Weakness in money supply growth was further compounded by regulatory efforts to "wring the water" out of China's financial system, by tackling the "empty circulation of funds" and various forms of fallow arbitrage.

Money supply growth remains anaemic

As of the end of May, China's M2 money supply stood at 301.85 trillion yuan, for year-on-year (YoY) growth of 7%, according to figures released by the People's Bank of China (PBOC) on 14 June.

The print was just below consensus forecasts for M2 growth of 7.1%.

The narrow M1 money supply stood at 64.68 trillion yuan as of the end of May, for a -4.2% drop in YoY terms, well below consensus forecasts of a -1.7% decline.

May marks the second consecutive month that China's M1 money supply posted a negative print and came in below expectations.

In China, the M1 money supply is defined as cash in circulation (M0) plus enterprise demand deposits, while the M2 money supply is M1 plus enterprise fixed-term deposits and household deposits.

Persistent uncertainty undermines lending

Lack of confidence amongst China's market actors played a key role in the ailing expansion of the money supply, by undermining new loans taken out by both households and enterprises.

New renminbi loans were 950 billion yuan in May, for a contraction of 410 billion compared to the same period last year.

New enterprise and institutional loans were 740 billion yuan, for a contraction of 115.8 billion yuan compared to the same period last year, and an on-month decline of 120 billion yuan.

New household loans were 75.7 billion yuan, for a contraction of 291.5 billion yuan compared to the same period last year, albeit an on-month rise of 592.3 billion yuan.

Total social financing (TSF) - a broad measure of credit and finance in the Chinese economy, nonetheless stood at 2.07 trillion yuan in May, for a YoY rise of 509.2 billion yuan, and an on-month increase of 2.14 trillion yuan.

Key drivers of this rise in TSF were the copious issue of government bonds including ultra-long-term treasuries, as well as bond financing by Chinese enterprises.

Is China "wringing the water" out of the financial system?

Wen Bin (温彬), chief economist at China Minsheng Bank, believes a significant factor behind faltering growth in the money supply has been efforts by Chinese regulators to "wring the water" out of the financial system by tackling the "empty circulation of funds."

According to Wen, this has "squeezed out the water of the empty increase in deposits."

"Following a marked reduction in the interest rates paid on deposits, the empty increase in the balance sheets of the banking system has come under pressure," he writes.

"This process has created major disruption for M1 growth."

Wen views this as a positive outcome for the Chinese financial system, however, by ensuring that credit is channelled towards more productive ends in the real economy.

"At present, with the main theme of actively 'wringing out the water,' increases in lending and the money supply have on the surface been modest.

"The removal of empty growth, however, means that financial data is more substantive, efficiency is higher, and corresponds with the demands of high-quality growth."

Strong bond market still undermines money supply

Efforts by regulators to keep interest rates down may have caused leakages elsewhere, however, which has also had the effect of undermining money supply growth by depleting bank deposits.

A key factor behind this has been the strong performance of the Chinese bond market. This has increased yields for bond-backed wealth management products (WMPs), triggering an exodus towards the instruments from bank deposits offering increasingly meagre interest rates.

In May, this trend was further exacerbated by the decision of Chinese regulators to put the kibosh on "manual supplementation of interest rates" (手工补息) - or discretionary increases in deposit rates by banks to attract customers.

According to Wen, this trend affected both enterprise and household deposits, and was a major cause of weak money supply growth.

"With the ban on manual interest rate adjustments for deposits continuing to take effect in May, in addition to the continuing outflow of household deposits towards non-bank assets under conditions of price differentials, some corporate deposits have also displayed a trend of disintermediation," Wen writes.

"Following the shift of the increase in credit from on-balance sheet to off-balance sheet [assets], the corresponding pace of money supply derivation has eased, and M2 growth has continued to come under pressure."

Other factors adversely affecting the M2 money supply in May included the increased issuance of government bonds - chiefly ultra-long treasuries, and tax payments that expanded the treasury account.

Chinese credit growth set to moderate permanently

Wen Bin expects China's credit growth to improve in the short term on the back of macroeconomic policy measures, as well as measures to boost China's ailing property market.

"Following opportune strengthening in monetary policy and the unleashing of fiscal policy, as well as the support of real estate and consumption policies, demand can be expected to gradually improve, and loan growth will expand correspondingly."

In the long term, however, Wen expects credit growth to moderate, as China's economy switches gears and regulators seek to give greater play to capital markets in the financial system.

"Following a lightening of the economic model, demand for credit will weaken, and regulators will focus on guiding the credit growth model from 'high-speed' to 'high-quality," Wen writes.

"During the process of the vigorous development of direct financing, the total volume and pace of growth in lending will fall compared to the previous period."