Beijing subsidises vehicle consumption, state-owned investment giant loses two top execs

A round-up of key economic and financial developments in China as of Tuesday, 11 June, 2024.

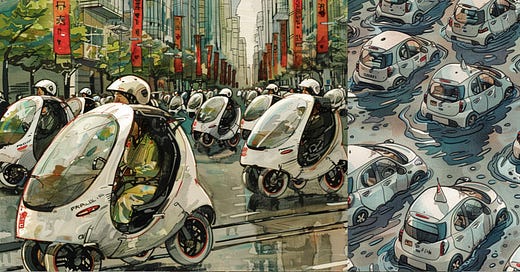

Beijing ponies up 6.44 billion yuan in auto subsidies for existing Chinese vehicle owners

The Ministry of Finance (MOF) recently announced the provision of 6.44 billion yuan in subsidies this year to spur the consumption of vehicles in China via the trading in of used vehicles for new purchases.

MOF indicated that the total amount allocated for the scheme in 2024 would be 11.19775 billion yuan, with local governments expected to pony up around 4.76 billion yuan of this amount.

In April, China's Ministry of Commerce (MOFCOM) released the "Implementation By-laws on Subsidies for Trading Used Cars for New" (汽车以旧换新补贴实施细则).

The scheme grants Chinese vehicle owners a one-time subsidy of 10,000 yuan if they trade in old internal combustion vehicles or clean energy vehicles registered before May 2018 to purchase clean energy passenger vehicles that meet standards set by the Ministry for Industry and Information Technology (MIIT).

China's goods exports up over 11%, auto exports surge 24%.

China's total trade in goods for the first five months of 2024 was 17.5 trillion yuan, for a year-on-year (YoY) rise of 6.3%, according to figures released by the General Administration of Customs (GAC) on 7 June.

This included 9.95 trillion yuan in exports for a 6.1% rise, and 7.55 trillion yuan in imports for a 6% rise.

China's trade surplus was 2.4 trillion yuan, marking an expansion of 5.2%.

China's strongest export area was electronics goods, which rose 7.9% for the first five months of 2024 to hit 5.87 trillion yuan, accounting for 59% of exports.

Automatic data processing equipment and components exports were 554.46 billion yuan for a 9.9% YoY rise.

Key areas of growth were integrated circuits, with exports rising 25.5% YoY to hit 444.73 billion yuan, as well as automobiles, with exports rising 23.8% to 329.7 billion yuan.

Mobile phone exports saw a slight dip, dropping 2.8% to 329.68 billion yuan.

Two senior execs toppled at state-owned investment giant CITIC Group

Two senior executives from China's leading state-owned investment firm have been toppled from their perches following the launch of investigations by disciplinary authorities.

The Central Commission for Discipline Inspection (CCDI) recently announced via its official website that it had assembled a team to investigate 58-year-old Xu Zuo (徐佐), deputy general manager and party committee member of CITIC Group, for disciplinary and legal breaches.

According to Securities Journal, 58 year-old Xu has a master's degree in industrial and commercial management and is considered a "senior economist" at CITIC.

He previously held a series of roles in the metallurgical and manufacturing sectors, before joining CITIC Daika Co., Ltd. as general manager in November 2007, and subsequently rising to the position of deputy-chair in June 2013.

In October 2016, Xu became assistant general manager at CITIC Group, as well as chair and party secretary of CITIC Daika.

Concurrent with the announcement of investigations into Xu Zuo, CCDI also announced punitive measures for another CITIC executive - former disciplinary commission member and supervisory office chair Xu Xiang (徐翔).

Xu has been expelled from the Communist Party and subjected to disciplinary measures for "lack of loyalty to the party," after accepting bribes in the form of wedding gifts, presents, and consumer voucher cards, as well as illegally participating in private parties and banquets.

Authorities in the Hebei province city of Xingtai have transferred the matter to the procuratorate authorities for further handling.

Beijing-headquartered CITIC was first founded in 1979 at the very outset of the reform and opening era, with the support of China's then-paramount leader Deng Xiaoping.

The company played a key role in expanding the footprint of China's state-owned investments throughout the 1980s, becoming a wholly state-invested company in 2011.

As of 2023, CITIC Group was ranked 100 on the Fortune 500, after making the list for the 15th consecutive year.

China launches first issue of 30-year ultra-long special treasuries

The Ministry of Finance (MOF) commenced the issuance of 45 billion yuan in ultra-long special treasuries with a maturity of 30 years on 7 June, according to a report from Shanghai Securities Journal.

Issuance of the treasuries will continue until 11 June, with the instruments scheduled to commence trading on Chinese exchanges starting from 13 June.

The issue marks the debut of 30-year ultra-long treasuries, which have a coupon rate of 2.57%.

At the Two Sessions congressional event held in March this year, the Chinese central government unveiled plans to issue trillions in ultra-long special treasuries over the next several years.

The treasuries will have tenors of between 20 years to a half-a-century, with funds raised to be used for infrastructure stimulus plans and alleviating the fiscal burdens of China's heavily indebted local governments.

MOF plans to issue one trillion in ultra-long treasuries in 2024 alone, during the period from May to November.

State-owned enterprises see profits rise 3.8%

Figures from MOF indicate that total operating revenues for China's national state-owned enterprises (SOEs) and state share-controlled enterprises hit 26.19236 trillion yuan for the first four months of 2024, for a YoY rise of 3.2%.

Total profits were 1.38132 trillion yuan, for a YoY rise of 3.8%, while payable taxes and fees were 2.03769 trillion yuan, for a YoY increase of 0.9%.

China's foreign reserves edge higher to USD$3.232 trillion in May

As of the end of May China's foreign reserves stood at USD$3.232 trillion, for an on-month rise of $31.2 billion, or 0.98%, according to figures released by the State Administration of Foreign Exchange (SAFE) on 7 June.

SAFE officials imputed the shift to "a fall in the US dollar index primarily as a result of monetary policy expectations and macroeconomic data for major economies, leading to an overall rise in global asset prices."