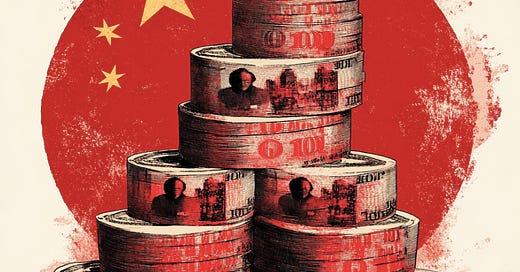

10 trillion yuan stimulus package expected to follow 9-24 monetary policy loosening

Chinese central bank to cut reserve ratio and policy rates. Li Xunlei says Beijing needs to dramatically increase leverage to boost economy.

Keep reading with a 7-day free trial

Subscribe to China Banking News to keep reading this post and get 7 days of free access to the full post archives.